Quarterly Report

Carmignac Portfolio Grande Europe: Letter from the Fund Manager

European Equity Market Review

In the period, European stocks continued to progress steadily higher, with very little daily volatility, bringing the year to date return to low-double digit. Equities continue to respond positively to the ongoing vaccine rollouts worldwide and the prospect of economies re-opening at some point later in 2021, thereby anticipating strong profit recovery across the equity market. However, whereas in the first quarter this optimism was accompanied by rising inflation expectations and significant increases in bond yields, in the second quarter bond yields in Europe, and globally, fell back on the realisation that many inflationary pressures are likely temporary aftershocks from lockdowns (ie: supply chain disruptions and tightness of labour supply, among others).

Portfolio Management

This backdrop brought about a sharp change in the leadership within the market. Previously, outperforming cyclical areas of the market like Banks, Oil & Gas, Commodities, and Autos started to lag the overall market. As we have little or no exposure to these areas, this change was beneficial for our comparative performance from a top-down perspective. Among the other sectors, the performance was quite balanced, but generally stocks with better long-term visibility performed best over the period. This has been the case for our Healthcare names and specifically for Novo Nordisk – the diabetes specialist – one of our best performers in the period. The stock responded well to a strong Q1 earnings’ report and also benefited from the approval in the US of a modified version of one of its drugs for the vast obesity indication – in full alignment with our investment thesis. Another stock that performed well is AstraZeneca, a pharmaceutical name we added in the quarter as we feel this is a particularly attractive opportunity based on the ongoing growth of their diversified portfolio of cancer drugs, among other therapeutic areas. To initiate this new position, we took advantage of a favourable entry point created by a M&A deal which we believe will be profit and cash flow accretive and will add to the company’s portfolio a franchise in the niche “rare” diseases market.

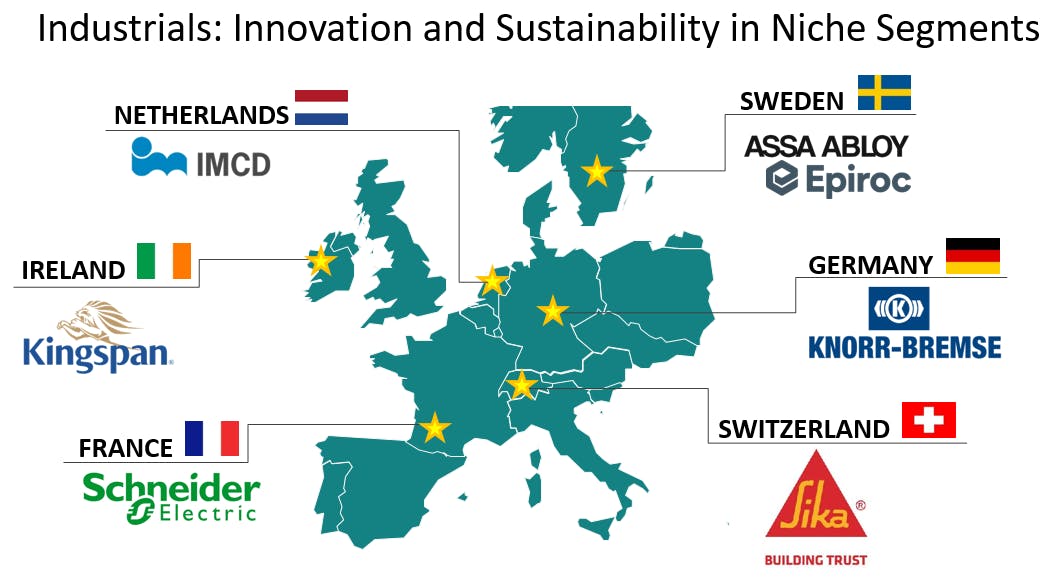

Our Industrial names were also another source of strong returns. Although cyclical stocks lagged in the period, our focus on high quality industrial names – characterised by high profitability benefiting from secular trends – stood us in good stead. One example is Kingspan – the insulation specialist – which is benefiting from ongoing demand for more energy efficient buildings and tighter building standards.

Other stocks delivering sustained profit growth, not only above 2020 levels but comfortably above 2019 as well, have been among our consumer names. LVMH saw its stock price rise in the quarter after a strong Q1 report, which was a testament to the strength of their brands. Although reducing our exposure after such a strong run, we retain our position in the name as we believe in the durability and desirability of consumer brands which have delivered results in a difficult environment such it was 2020.

On the negative side, we continued to see significant weakness in our renewable energy names especially Vestas – wind turbines – and Orsted – offshore wind farms. These stocks got ahead of themselves early in 2021 but now that prices have fallen dramatically from their peak levels, we think they look attractive again, especially given the rise in yields has abated. For these reasons, we have been gradually increasing our positions in both names, as well as adding to Solaria – the Spanish solar farm developer. Positive news flow momentum should also pick up in the coming months as more announcements related to spending of the EU Recovery fund in the second half of 2021 should be more targeted to “green” projects. We also believe an extension of renewable tax credits in the US is possible.

Outlook

Heading into the second half of 2021 the broad structure of the portfolio is unchanged and remains a consequence of our bottom-up stock picking process which focuses on profitable companies with high return on capital. Such companies, we believe, are the most attractive names for investors who are seeking sustainable long-term returns.

Carmignac Portfolio Grande Europe A EUR Acc

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

2025 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Portfolio Grande Europe A EUR Acc | -1.40 % | +5.11 % | +10.36 % | -9.56 % | +34.79 % | +14.46 % | +21.73 % | -21.09 % | +14.75 % | +11.27 % | -4.32 % |

| Reference Indicator | +9.60 % | +1.73 % | +10.58 % | -10.77 % | +26.82 % | -1.99 % | +24.91 % | -10.64 % | +15.81 % | +8.78 % | +5.91 % |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Portfolio Grande Europe A EUR Acc | +3.30 % | +9.47 % | +5.46 % |

| Reference Indicator | +8.25 % | +13.51 % | +5.72 % |

Scroll right to see full table

Source: Carmignac at 31/03/2025

| Entry costs : | 4,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge. |

| Exit costs : | We do not charge an exit fee for this product. |

| Management fees and other administrative or operating costs : | 1,80% of the value of your investment per year. This estimate is based on actual costs over the past year. |

| Performance fees : | 20,00% when the share class overperforms the Reference indicator during the performance period. It will be payable also in case the share class has overperformed the reference indicator but had a negative performance. Underperformance is clawed back for 5 years. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years. |

| Transaction Cost : | 0,64% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell. |

Carmignac Portfolio Grande Europe A EUR Acc

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.

Source: Carmignac, 30/06/2021.