Funds in Focus

Carmignac P. Unconstrained Global Bond & Charles Zerah : 10-year anniversary

For investors with high volatility tolerance looking for bond performance drivers at a time when yields are extremely low and subject to volatility spikes.

During periods of market volatility, Charles Zerah, Fund Manager of Carmignac P. Unconstrained Global Bond may:

Make its overall portfolio more resilient by reducing directional risk, lowering beta exposure to duration (or even being negative duration) and credit risk and tilting toward relative value opportunities

Seize opportunities that arise in volatile periods, providing debt capital to ‘liquidity-hungry’ issuers when they are most in need.

Why invest in the Fund now?

The decades-long secular decline in interest rates across developed countries, which has been a major boon to fixed income total returns over the years, appears to have reached its lower bound with 10-year US Treasury yields and 10-year German yields respectively reaching +0.6% and -0.41.

If yields did begin an upward trend, returns to bond investors would be materially adverse. Since most common Fixed Income benchmarks have durations over 8 years (for instance the JPMorgan GGB index has a duration of 8), it implies a negative price return of approximately -8% for every 1% increase in interest rates2.

Our Unconstrained bond strategies like Carmignac P. Unconstrained Global Bond benefit from greater investment flexibility to defend against scenarios that are challenging for traditional Fixed Income Funds while potentially capitalizing on market shifts.

(1) Source: Bloomberg as of 03/06/2020

(2) Source: Bloomberg

What are the main assets of the Fund?

Carmignac P. Unconstrained Global Bond is the “pioneer” in our unconstrained range, a philosophy à la Carmignac that relies on 3 pillars: flexibility, global approach and non-benchmarked management, shared among all our Fund Managers.

-

A wider modified duration bracket or the ability to take long or short positions on rate, credit and currency markets may help navigate a wider variety of market conditions relative to traditional strategies.

-

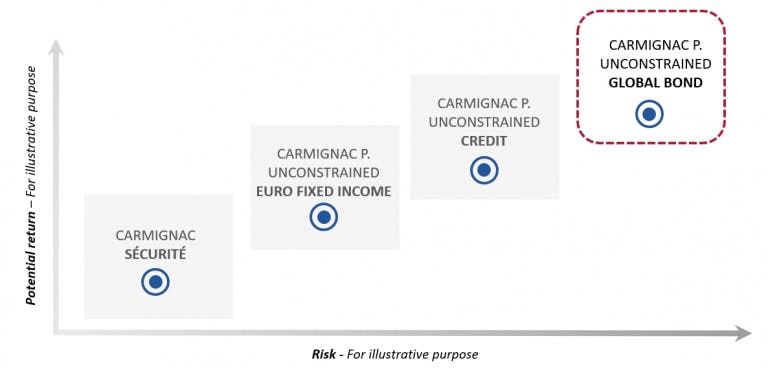

Carmignac Fixed Income Range

Carmignac P. Unconstrained Global Bond positioned in the top-right part in terms of risk/return profiles

Source: Carmignac, 31/05/2020. Potential Returns are forecasts. Performance forecasts are not a reliable indicator of future performance. Risk level based on 52-week volatility average of the Funds since 31 July 2017 (launch date of Carmignac Portfolio Unconstrained Credit) as of 31 March 2020. The risks, fees and ongoing charges are described in the KIID (Key Investor Information Document). The KIID must be made available to the subscriber prior to subscription. For illustrative purpose only, do not take into account investors’ specific individual circumstances and must not be interpreted as investment advice.

On March 10th, 2021, four of our Fixed Income Funds have changed their name. The word “unconstrained” has been removed and Carmignac Portfolio Unconstrained Euro Fixed Income has been renamed Carmignac Portfolio Flexible Bond.

Performance figures during Charles Zerah's management

Figures below, as of 29/05/2020, are a reflection of Charles Zerah's tenure managing Carmignac Portfolio Unconstrained Global Bond A Eur Acc share class since 26/02/2010.

-

1st quartileof the Global Bond Morningstar category for its 10-year performance

-

4.5%annualized performance during the management period of Charles Zerah

-

7.2%52-week volatility on average

-

0.0correlation to global equity markets over Charles’ 10–year tenure

-

3axes of performance added performance to the Fund over 10 years : rates, credit and to a lesser extent currencies

-

89%of the 3-year performance periods rolled monthly are above the Global Bond Morningstar category average

![[Insights] 2020 06_FF_CGB (Pro) 2 EN](https://carmignac.imgix.net/uploads/article/0001/12/2dbbd2034eaf4e97ad64a0ca6e468fe8a0e74b92.png?auto=format%2Ccompress)

Source: Carmignac, 29/05/2020.

(3) Charles Zerah arrival (26/02/2010). Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding applicable entrance fee due to the distributor). The return may increase or decrease as a result of currency fluctuations. Portfolio composition may be changed anytime without notice.

(4) A Eur Acc share class.

(5) Global Bond Morningstar category. Morningstar Rating™: © May 2020 Morningstar, Inc. All rights reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

(6) JP Morgan Global Government Bond Index (JNUCGBIG), coupon reinvested.

Carmignac Portfolio Global Bond Income E USD Hdg

Recommended minimum investment horizon

Lower risk Higher risk

CREDIT: Credit risk is the risk that the issuer may default.

INTEREST RATE: Interest rate risk results in a decline in the net asset value in the event of changes in interest rates.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.

*Risk Scale from the KIID (Key Investor Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. A EUR Acc share class ISIN code: LU0336083497.