Flash Note

![[Main media] [Flash Note] [EM] Sunrise boat](https://carmignac.imgix.net/uploads/article/0001/03/45a9ae949d3326862404d02160f9ce00e33a75ef.jpeg?auto=format%2Ccompress)

The untapped opportunities in frontier markets

The heterogeneous world of frontier markets

Frontier markets are countries that are still a step behind emerging markets, but have the potential to narrow the gap in terms of risk/return and liquidity in a few years’ time. Some of them are more flourishing than many a developed country, and yet their capital markets appear to be too shallow and too illiquid to withstand comparison with those in full-fledged EM countries. Other frontier markets lag their EM counterparts from the standpoint of economic development (or they may even be countries that have backslid from their former emerging status).

While EM equities are now amply covered by financial analysts, those in frontier markets – where foreign investors typically account for a very small share of total capitalisation – often hold untapped potential. Due to the catch-up process under way, active investors will find attractive prospects for long-term growth in frontier markets, particularly as many of them have recently initiated economic reforms. However, all of these countries have their own specific issues and development drivers, and are more responsive to domestic conditions than to global factors. That highlights the need to study them one by one – and to put solid risk-management policies in place.

The frontier markets space runs the gamut from Qatar, which boasts higher GDP per capita than even the vast majority of developed economies, to Kenya, one of the world’s poorest nations. Little wonder, then, that in 2018 Qatar’s stock market surged by roughly 24%, whereas Kenya’s fell by 16% (in dollars). Similarly, an economy based on manufacturing, as in Bangladesh, won’t respond to external shocks in the same way as an economy highly dependent on tourism, as in the case of Sri Lanka.

![[Insights] 2019 05_FN_Exp_EM (All) 1 EN](https://carmignac.imgix.net/uploads/article/0001/09/thumb_8164_article_desktop.png?auto=format%2Ccompress)

The vital need to be selective

The low liquidity typical of frontier markets and their tendency to include a large number of public-sector entities underscore the need for strict risk management. What makes being selective so crucial is that many frontier markets aren’t very attractive at this stage. For example, among the higher-profile countries in the category, we take an extremely cautious view of Nigeria, where economic fundamentals have weakened to such an extent that a recession may be coming up. Oil production, a key driver of the Nigerian economy, fell significantly during the first half of 2018. But even as tax revenues dwindled, public spending increased, forcing the government to issue bonds that merely added to an already substantial debt burden. In political terms as well, there is mounting uncertainty as security issues have arisen in the northeast of the country. The Nigerian stock market lost 18% over 2018 (in US dollars).

Where do the opportunities lie in 2019?

We take an interest in those frontier nations that are relatively open to foreign investors and that enjoy a fair degree of economic and political stability. We accordingly favour economies in Asia, which show considerable variety and include a good many pockets of growth. In those of them with current account surpluses and a number of underpenetrated sectors (i.e., underdeveloped relative to the size of the economy and compared to other emerging and developed countries), we have identified a sizeable share of companies that meet our investment criteria.

![[Article image] [Flash Note] Vietnam](https://carmignac.imgix.net/uploads/article/0001/08/c4da76e511cb379aba3e4787d24b4c9f7c25d7ad.png?auto=format%2Ccompress)

We particularly appreciate Vietnam, a country with solid economic fundamentals (output growth of circa 6.5% and a current account surplus equivalent to about 6% of GDP) that over the past few years has implemented reforms geared to opening up its economy to foreign investors. Vietnam has availed itself of a great opportunity to develop into one of the world’s major manufacturing hubs on the back of China’s withdrawal from low-cost manufacturing. As a result, foreign direct investment (FDI) has risen sharply.

Frontier markets offer investors diversification opportunities

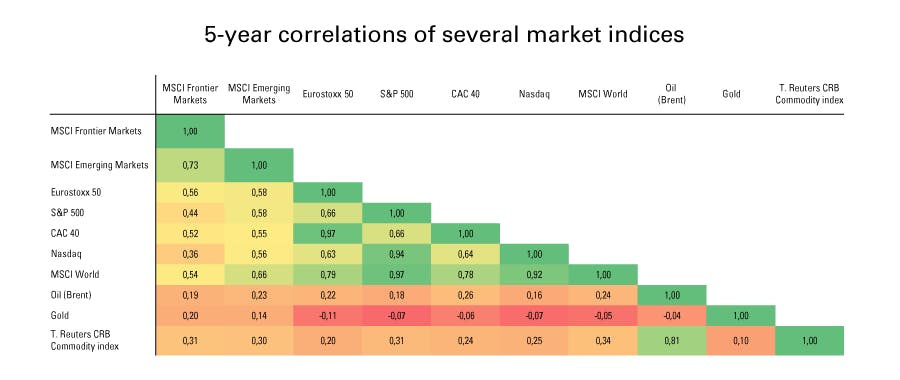

Frontier equity markets also offer genuine opportunities for diversification, as they historically show low correlation with their developed-world equivalents – under 0.6.

That low correlation is attributable to both the limited presence of foreign investors and low indebtedness in the economy, which make these countries less sensitive to international capital flows.

Furthermore, frontier markets’ equities offer opportunities for geographic diversification across Europe, Africa, Latin America and Asia. They also display a small- and mid-cap bias that can open up additional sources of return. These companies are inadequately covered by financial analysts and, due to a lack of information, few investors take much interest in them, thereby creating share-price inefficiencies. This provides major opportunities for active fund managers who can draw on in-house research capabilities. The small- and mid-cap companies in frontier markets tend to cater to domestic demand and are therefore positioned to leverage the likely uptrend in local consumer spending. Their extremely good long-term growth prospects and low correlation with developed-world markets make them an excellent potential source of diversification for investors.

Frontier markets harbour such a wide array of economic and financial conditions that require strong analytical capabilities and strict risk-management processes in order to tap into these opportunities