Flash Note

Carmignac Emergents: Letter from the Fund Managers

Q1 2021

Carmignac Emergents1 recorded a performance of +2.61% in the first quarter of 2021, compared with a +6.48% increase in its reference indicator2.

What happened in Emerging Markets during the first quarter of 2021?

During the quarter, emerging-market equities extended the rally kicked off in March last year after the leading central banks, particularly the Fed and the ECB, moved to expand their balance sheets with highly aggressive quantitative easing. However, the market rally in this first quarter was different from the one in 2020 because this time cyclical and value stocks outperformed growth stocks. That difference resulted from rising nominal and real US interest rates, particularly on the long end of the yield curve. Investors have begun to price in the gradual re-opening of economies, including the retail, service and tourism sectors, encouraged by steep declines in Covid-19 hospitalisations and deaths in countries that have reached high vaccination levels.

How was the fund positioned?

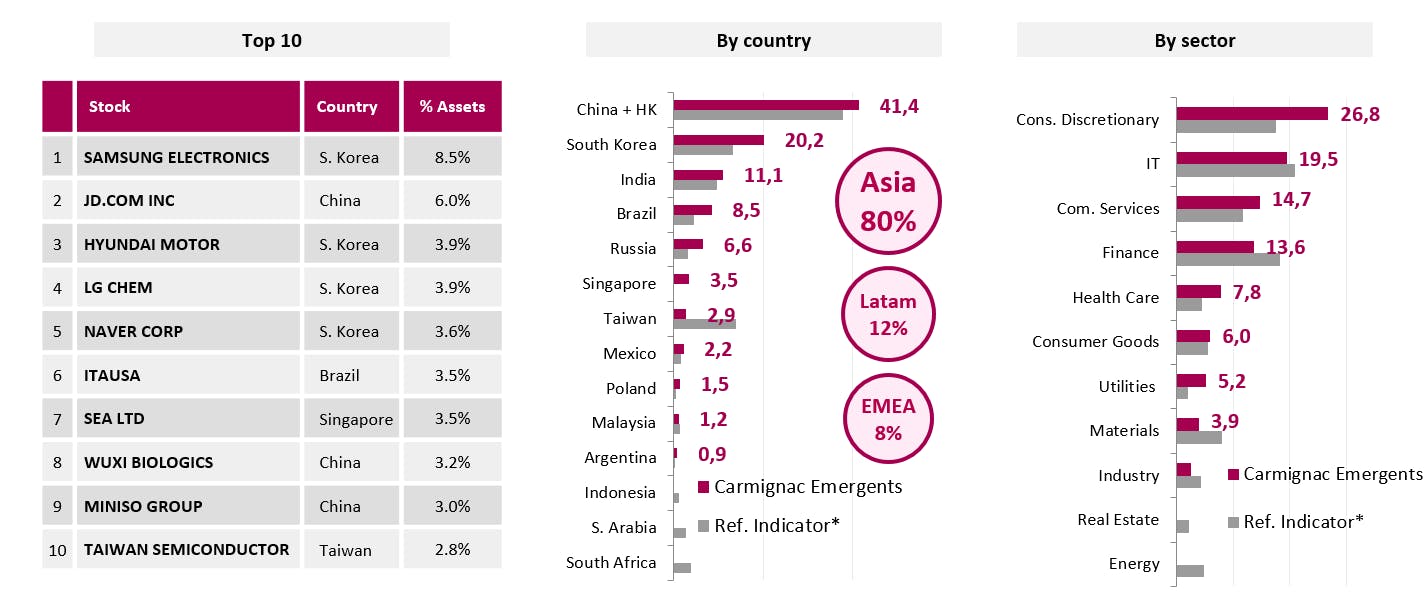

Against this backdrop, given our positioning, focusing primarily on long-term growth themes with little exposure to cyclical industries, the Fund lagged its reference indicator2. It is worth pointing out, however, that we did partially anticipate the sector and thematic rotation that followed the significant outperformance by growth stocks in 2020. That is why, at the beginning of the year, we proactively increased our exposure to commodity-exporting countries such as Russia and Brazil and stepped up our allocation to quality cyclical names in South Korea such as Hyundai and Samsung Electronics and to Maruti Suzuki and ICICI Lombard in India.

During the first quarter, we also continued our profit taking strategy, reducing or closing positions on stocks we consider having stretched and overpriced valuations, exiting our holdings in China’s two electric-vehicle manufacturers, Nio and BYD. This sector has been rendered highly attractive by Beijing’s ambitions and recent regulations to promote the shift to e-Mobility. However, based on our analysis, we still believe that those stocks are currently overvalued as new Chinese and foreign competitors enter the market, inevitably exerting downward pressure on profit margins. We have therefore changed our focus in the EV sector by investing in LG Chem, a South Korean battery-maker that has become one of our largest holdings, accounting for 3.9% of the Fund’s net assets (as of 31/03/2021). As the sector is characterised by high barriers to entry (in terms of both technology and capital expenditure), we expect attractive profits perspectives for the leading players in this space – with LG Chem being one of them.

We also added Fix Price, Russia’s leading retailer of low-priced products, to our portfolio during the quarter. Since the mid-2010s, Carmignac Emergents has largely pulled out of retailers like superstores, but even smaller-scale outfits as well. We feel that with the ongoing digital revolution putting considerable pressure on the business models of those companies, delivery and logistics providers are capturing an increasing share of the value added in the business. With regard to Fix Price, our view is that discount variety stores are the only format that can still be profitable in a digital era, given that e-commerce cannot match their low prices, least of all in Russia due to logistics constraints. This new position has given Russia a 6.5% weighting in the Fund’s net assets (as of 31/03/2021), which is still primarily invested in Asia (80% of total assets). This reflects the attractive economic fundamentals of a region featuring higher growth and better economic governance than its other emerging and developed market peers.

What is our outlook for the coming months?

We have kept our constructive outlook on China, which is still our biggest country allocation, accounting for 40.7% of total assets including Hong Kong (as of 31/03/2021). In our view, China is home to the world’s most effectively managed major economy. Beijing’s fiscal and monetary orthodoxy stands in contrast to the skyrocketing debt levels of developed-world households, companies and governments, leaving the country with sounder economic fundamentals. The renminbi has in fact been the strongest major currency in the world since the onset of the pandemic.

During the quarter, we added a new Chinese name to our portfolio. Tuya, the world’s number-one Internet-of-Things company3, has developed an entire ecosystem of connected objects (electrical outlets, light bulbs, thermostats, lighting, roller blinds, alarms, water and gas valves, video entry phones, cameras, entrance gates, garage doors, sprinklers, circuit-breakers, home appliances and more) that enables users to control their “smart homes” remotely via a single app. We believe that the Internet-of-Things could well represent the next stage in the industrial revolution. And as the world leader in that business, we believe Tuya is poised to benefit from its first-mover advantage, as well as on the fact that it is in the interests of all companies to be dealing with a single application platform.

We also initiated a position in Ehang, China’s top electric-drone manufacturer. The company’s drones are already in use in China for topographic mapping, aerial photography and fire-fighting. But the market has yet to price in the potential of air taxis – and Ehang has already signed several contracts4 for such taxis with a number of tourist sites in various Chinese cities.

The Fund’s net assets are still primarily invested in Asia (80% of total assets, as of 31/03/2021). This reflects the attractive economic fundamentals of a region featuring higher growth and better economic governance than its other emerging and developed market peers.

Current Positioning & Biggest Convictions

Carmignac Emergents

Grasping the most promising opportunities within the emerging universe

- Built on longstanding emerging market expertise, aimed at capturing the most profitable equity opportunities.

- An actively managed equity exposure to adapt to changing market conditions and limit volatility.

- Environmental, social and governance criteria are fully integrated to the investment process.

SFDR5 Fund Classification: Article 8

SFDR5 Fund Classification: Article 8

|

SRI Label www.lelabelisr.fr/en |

|

Towards Sustainability label www.towardssustainability.be |

Carmignac Emergents A EUR Acc

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

2025 (YTD) ? Year to date |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Carmignac Emergents A EUR Acc | +5.15 % | +1.39 % | +18.84 % | -18.60 % | +24.73 % | +44.66 % | -10.73 % | -15.63 % | +9.51 % | +4.63 % | - |

| Reference Indicator | -5.23 % | +14.51 % | +20.59 % | -10.27 % | +20.61 % | +8.54 % | +4.86 % | -14.85 % | +6.11 % | +14.68 % | - |

Scroll right to see full table

| 3 Years | 5 Years | 10 Years | |

|---|---|---|---|

| Carmignac Emergents A EUR Acc | -1.13 % | +4.53 % | +4.85 % |

| Reference Indicator | +1.19 % | +3.35 % | +5.26 % |

Scroll right to see full table

Source: Carmignac at 31/12/2024

| Entry costs : | 4,00% of the amount you pay in when entering this investment. This is the most you will be charged. Carmignac Gestion doesn't charge any entry fee. The person selling you the product will inform you of the actual charge. |

| Exit costs : | We do not charge an exit fee for this product. |

| Management fees and other administrative or operating costs : | 1,50% of the value of your investment per year. This estimate is based on actual costs over the past year. |

| Performance fees : | 20,00% max. of the outperformance once performance since the start of the year exceeds that of the reference indicator and if no past underperformance still needs to be offset. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years. |

| Transaction Cost : | 0,88% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell. |

Source: Carmignac, EM Advisors Group, Bloomberg, 31/03/2021.

1Carmignac Emergents A EUR Acc (ISIN: FR0010149302).

Past performance is not necessarily indicative of future performance. The return may increase or decrease as a result of currency fluctuations. The portfolios of Carmignac funds may change without previous notice. Performances are net of fees (excluding possible entrance fees charged by the distributor). Annualized performance as of 31/03/2021.

2Reference indicator: MSCI EM NR USD. Daily returns in EUR as of 31/03/2021.

3Sources: Bloomberg, Company data, CICC Research, Based on 31/01/2021 market share figures.

4Sources: Company data, Roland Berger Research, Based on 31/03/2021 company disclosure & report.

5Sustainable Finance Disclosure Regulation (SFDR) 2019/2088. For more information please refer to EUR-lex.

Carmignac Emergents A EUR Ydis

Recommended minimum investment horizon

Lower risk Higher risk

EQUITY: The Fund may be affected by stock price variations, the scale of which is dependent on external factors, stock trading volumes or market capitalization.

EMERGING MARKETS: Operating conditions and supervision in "emerging" markets may deviate from the standards prevailing on the large international exchanges and have an impact on prices of listed instruments in which the Fund may invest.

CURRENCY: Currency risk is linked to exposure to a currency other than the Fund’s valuation currency, either through direct investment or the use of forward financial instruments.

DISCRETIONARY MANAGEMENT: Anticipations of financial market changes made by the Management Company have a direct effect on the Fund's performance, which depends on the stocks selected.

The Fund presents a risk of loss of capital.