2021, a year of active stewardship illustrated

As part of our commitment to improve corporate governance practices, we actively engage with the companies we invest in. We assess their ESG behaviour, exercise our shareholder voting rights, help instil best practices, clarify our views and hold senior management accountable when issues arise.

Split of engagement objectives - Carmignac 2021 engagements

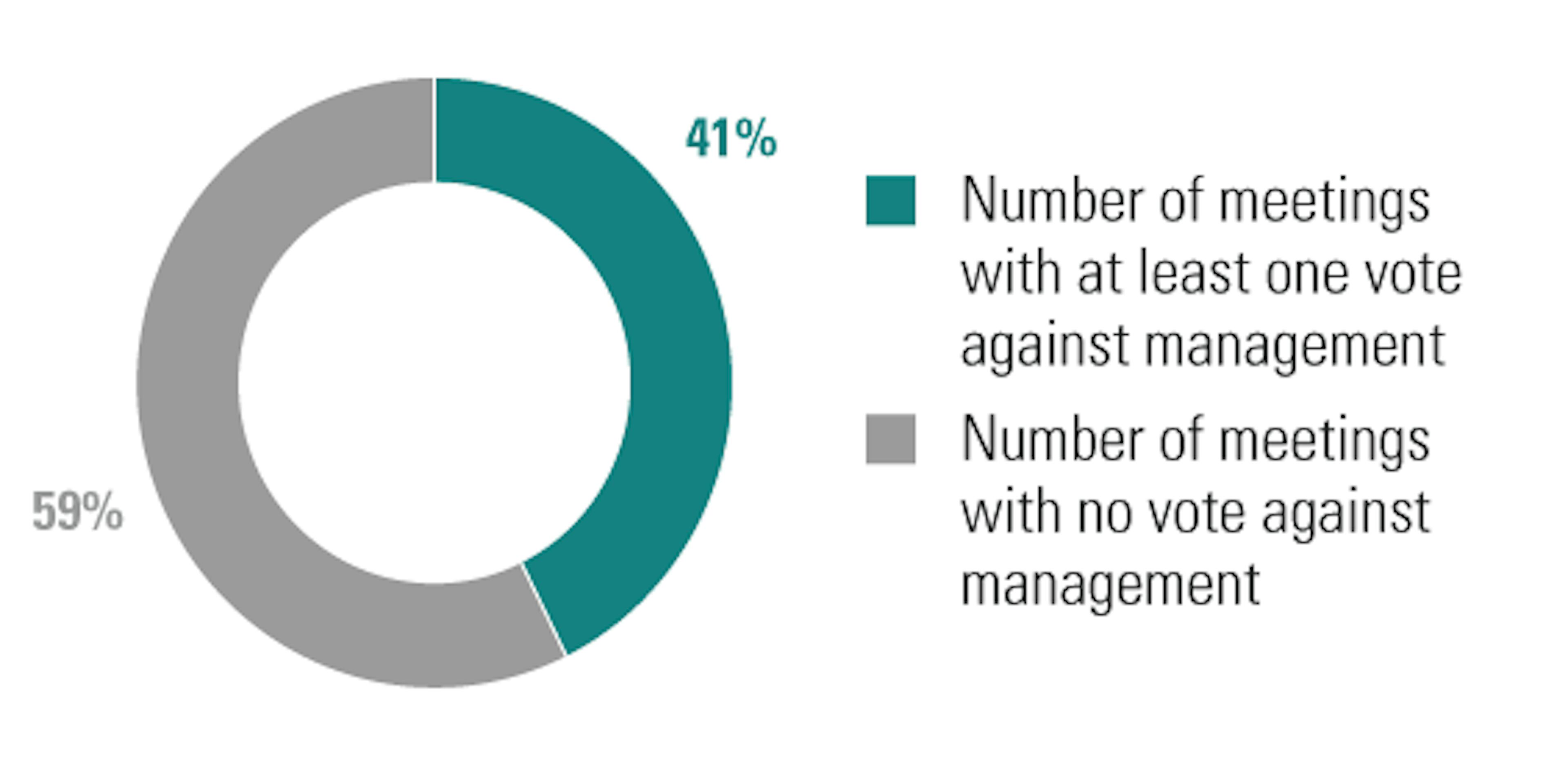

Meetings voted for/ against Management

Engagement Case Studies

TotalEnergies

Sector: Oil&Gas

Region: Europe

The company’s equity is held within Carmignac Portfolio Green Gold, our thematic ESG

fund which invests in innovative companies that are actively addressing or contributing to

climate change mitigation across the whole renewable energy and industry value chains.

Carnival corporation & plc

Sector: Hotel, restaurants & leisure

Region: North America & UK (dual-listed)

A number of Carmignac’s fixed income funds are invested in the company.

Related articles

Taking another look at ESG integration in sovereign investments

2024: Our active stewardship illustrated

Our 2024 retrospective: The main market events and their ESG implications

This is a marketing communication. This document is intended for professional clients.

This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice. This material has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purposes. The information contained in this material may be partial information and may be modified without prior notice. They are expressed as of the date of writing and are derived from proprietary and non-proprietary sources deemed by Carmignac to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Carmignac, its officers, employees or agents.

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice.

UK:This document was prepared by Carmignac Gestion and/or Carmignac Gestion Luxembourg and is being distributed in the UK by Carmignac Gestion Luxembourg UK Branch (Registered in England and Wales with number FC031103, CSSF agreement of 10/06/2013).

In Switzerland: the prospectus, KIIDs and annual report are available at www.carmignac.ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Paris, succursale de Nyon/Suisse, Route de Signy 35, 1260 Nyon.

Copyright: The data published in this presentation are the exclusive property of their owners, as mentioned on each page.

CARMIGNAC GESTION 24, place Vendôme - F-75001 Paris - Tél : (+33) 01 42 86 53 35

Investment management company approved by the AMF

Public limited company with share capital of € 15,000,000 - RCS Paris B 349 501 676

CARMIGNAC GESTION Luxembourg - City Link - 7, rue de la Chapelle - L-1325 Luxembourg - Tel : (+352) 46 70 60 1

Subsidiary of Carmignac Gestion - Investment fund management company approved by the CSSF

Public limited company with share capital of € 23,000,000 - RC Luxembourg B 67 549